Small Business Revolving Lines of Credit -

Access to the capital you need, when you need it, on your terms. No Prepayment Penalties, Just Prepayment Discounts, And Access to More Funds.

Rates are starting at just 3.48% with access up to $500,000. Approvals within minutes of applying!

5 Star Rated on Trustpilot and Google | A+ BBB

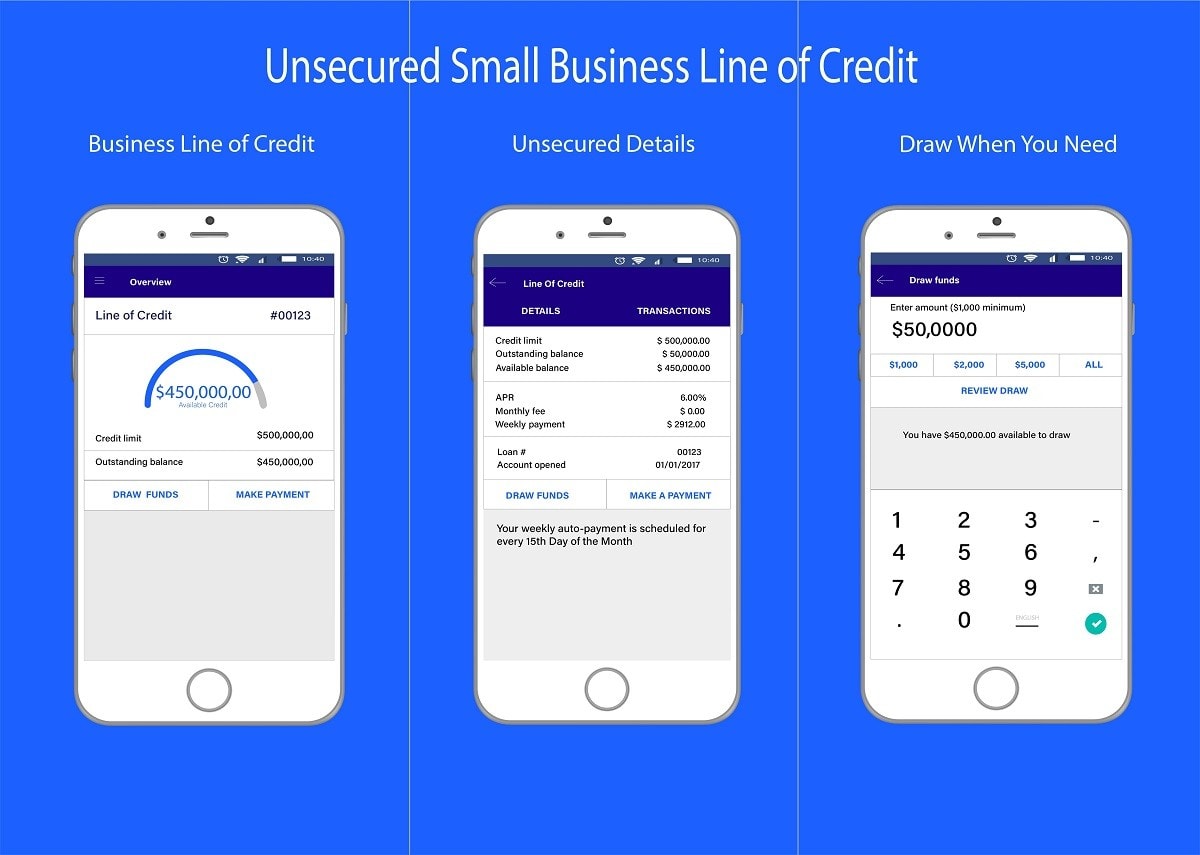

What happens when your business needs working capital and is short on cash to address the situation? Have you ever looked back on the opportunities you have had but did not have the money necessary to take advantage of the investment? Every small business across the united states should have the ability to access capital at their fingertips. Our Small Business Line of Credit Program makes this desire a reality. With a US Fund Source unsecured small business line of credit, you gain access to an unsecured revolving line of capital that enables you to draw funds as the need arises.

The process for applying for a secured or

unsecured business credit line is simple! Requirements include your last 3 to 6 months of business banking statements and a 1-page electronic application. Our financial technology gives us the capability to approve some account within 5 minutes of applying. This rule speaks depending on the size of your company, and some businesses can be approved for an

unsecured business credit line through financial technology in less than 5 minutes. Others typically take no more than 24 hours to underwrite and accept.

When an unexpected or even expected opportunity, purchase, bill, or investment arises, go online and access your US Fund Source line of credit. Select the amount you wish to utilize, select draw, and the funds are sent via wire to your account within hours. (8 A.M. to 5 P.M. EST) No additional paperwork required after your initial approval, and it is that easy. No hassle or waiting around involved here!

You are in control of the funds because on a day to day scale, and you know what's best for business.

Advantages of a Small Business Line of Credit: Best Options and Benefits

- Immediate Access to Funds

- Ability to repay and borrow again as needed.

- Completely Unsecured with NO Collateral required

- Only Pay on Your Outstanding Balance and Not Your Approved Loan/Line Amount

- Increase your credit line without Further Documentation Needed

- Every Payment is 100% Tax-Deductible

- Build Business Credit

- Improve Business Adaptability

Line of Credit Uses-

- Secure unexpected growth opportunities

- Increase Inventory or Discounted Bulk Inventory Purchases

- Financially support operating expenses such as supplies and payroll

- Payoff High-Interest Credit Cards or Cash Advance Loans

- Renovation or Expansion

- Emergency Funds for Unexpected Situations

- Asset purchases

- Even out Cash Flow for Seasonal Businesses

- Unforecasted Expenses

A business line of credit is a revolving line of credit that you can draw against as you need it. It is typically used for short-term working capital to help improve cash flow or to finance unforeseen expenses. It is also commonly used to take advantage of unexpected opportunities or investments. An

unsecured business credit line provides flexibility that a typical term loan does not. With business lines of credit, you can borrow up to your approved limit, and only pay interest on the portion of money you borrow over the term you acquire it. The sooner funds are paid back, the cheaper the cost of capital — business lines of credit act similar to how credit cards work without the high cash advance costs.

A vital characteristic of a small business credit line is that it is revolving. A revolving line of credit is where subsequent draw(s) taken after the initial funding are only restricted by the approval amount or, in other words, maximum credit limit, and there is not a pay-down requirement. In other words, the small business can access the line of credit as long as the small business has not hit its maximum credit limit (Typical unsecured business lines of credit approvals average at $250,000.00 and range from $5,000.00 to $500,000.00). As we mentioned before, one of its main attractions is its flexibility.

What are Small Business Open Credit Lines? How do Small Business Lines of Credit Work?

A small business line of credit is very similar to a business credit card. The critical difference is that you can borrow up to a certain amount of capital in cash, say $250,000, and pay interest only on the portion of money you borrow over the term you acquire it. You also do not have the high cash advance interest rates than a credit card carries. You can then draw and pay back the funds as you wish, with the only restriction being making the minimum payment. As long as you do not exceed the maximum revolving credit limit, you can always access more

business capital or cash.

Unsecured business lines of credit are also affected by payback history. As a borrower pays back, their credit line limits can be increased within six weeks and reviewed monthly after that. The ceiling is not a lifetime one, as is the case with individual

term loans, but rather the highest dollar amount a merchant can borrow at one time. This is a crucial difference in regards to a

term loan, where a specific amount is paid back over a one time designated term. A small business line of credit allows the company owner to borrow the amount of cash needed at any time. They also can take advantage of prepayment discounts by making payments over the minimum required dollar amount. This type of funding can help businesses mitigate the waves of cash flow, especially when awaiting payments on receivables/invoices.

Are there different types of lines of credit for small businesses?

In the United States, US Fund Source provides two different types of credit lines. Generally speaking, these lines are considered either secured or unsecured.

A secured line of credit is backed by collateral. Typically this can be inventory, equipment, real estate, or some other asset with a market value justifying the credit limit.

The most popular business line of credit is an unsecured line of credit. An

unsecured business line of credit is a debt financing instrument that offers revolving credit access but does not require you to provide any collateral to secure the specific revolving credit limit. An unsecured line of credit is based on the cash flow and debt to income ratio of the business. The credit of the owner/owners, as well as the business credit of the entity itself, is also considered.

When and why would a business line of credit be a good option?

The most common reason to open a business line of credit is to gain access to short term funding in which companies tend to use these funds to support financing for operational expenses. However, there are also many other benefits and reasons for establishing a small business line of credit with a private lending institution. US Fund Source is one of the few companies that advise, provide, and service secured and unsecured business lines of credit.

A business line of credit is a great asset to have when it comes to financing options. Having it before you need it is a crucial benefit as you do not pay interest until you draw the funds requested. It is like having an open account with a healthy balance on hand ready to go. The best time to qualify is when your business is healthy and lacks little or no cash flow problems. However, in today's Fintech ( Financial Technology ) world, qualifications for small business credit lines have widely broadened. It is important to remember that interest is only charged on the amount drawn or borrowed.

All and all, a business line of credit is a great option, especially when a company has multiple projects going on simultaneously but with different start and completion dates. For example, a construction or contracting company that needs to pay for supplies and payroll on multiple products can use a line of credit to help ease the strain on cash flow while awaiting payments for completed or near-completed projects.

A line of credit can also be an excellent idea for a business that experiences seasonality. For example, this could be a hospitality company that is located in a specific area that is directly affected by weather conditions. It offers a high level of flexibility, and businesses can draw on it on an as-needed basis.

Small business lines of credit are also a great way to establish a positive credit history. Building business credit with companies such as

Dun & Bradstreet can also set you up to qualify for the best term loans and other means of lending instruments available. It is one of the cheapest and most effective methods of growing your business both financially and historically.

What are the requirements for a business line of credit?